Do Air Conditioners Qualify For Residential Energy Credit

Keeping this in consideration is there a residential energy credit for 2019. Any wind turbines used to.

Http Theairconditioningpros Com Miami Ac Service Miami Looking For Professionals In Air Conditioning System Air Conditioning Installation Work Infographic

Water heaters powered by solar energy that provide at least half of the homes total water heating in a residential property.

Do air conditioners qualify for residential energy credit. There are a number of limits on both categories including. Some energy-efficient products have specific dollar caps such as 150 for gas propane and oil furnaces while central air conditioning has a 300 limit. A qualifying home air conditioner must be a CAC or central air conditioning unit.

Make sure that you take advantage of these two credits if you are eligible. Split system air conditioning - must meet 25C requirements of 16 SEER13 EER both efficiency levels must be met to. Not all air conditioners will pass the test so before you deduct the amount of the credit for your adjusted gross income be certain your home air conditioning unit qualifies.

However with the Consolidated Appropriations Act of 2021 geothermal systems wind turbines and fuel cells are on a gradual step-down incentive. It only has to be in the US. To verify tax credit eligibility ask your HVAC contractor to provide the Manufacturer Certification Statement for the equipment you plan to purchase.

Theres also an additional credit available on the solar module used to generate electricity for your new HVAC components. Click the screenshot below for reference To enter your energy-efficient property in TurboTax. The following Trane residential products qualify for a federal tax credit.

Customers should consult with a tax professional to fully understand how the tax credits may apply to you what you can do to obtain one and for advice on. In 2020 the government extended the previously-expired Non-Business Energy Property Tax Credits on residential air conditioning equipment. Your home does not have to be your main residence.

Central air conditioning Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for a 300 tax credit. Youll enter the cost of the AC system under Tell Us How Much You Paid for Energy-Saving Improvements as an Energy-Efficient Building Property. Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified propertyQualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines and fuel cell property.

Does a central air conditioner qualify for energy credit. While installation costs generally qualify for under the residential energy credit not all installation costs. Subject to IRS regulations tax credits apply as a direct reduction of taxes owed.

300 maximum credit available for qualifying central Air Conditioners Heat Pumps Packaged Units and Ductless Mini-Split Systems. 150 maximum credit available for qualifying Furnaces and Boilers. Click to read full answer.

Qualifying properties are solar electric property solar water heaters geothermal heat pumps small wind turbines fuel cell property and starting December 31 2020 qualified biomass fuel property expenditures paid or incurred in taxable years. Having a solar-ready heat pump or air conditioner installed in your home before December 31 2021 may qualify you for a federal tax credit of up to nine percent of the equipments cost. This means that certain qualifying air conditioners and heat pumps installed through December 31 2021 are eligible for a 300 tax credit.

The tax credit itself includes 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs. Tax Credits on Solar Energy Through 2021. If your system was installed before December 31 2019 the tax credit is 30 26 if installed by January 1 2023 and 22 if installed by January 1 2024.

If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal residence and is placed in service between January 1 2021 and December 31 2021 then the homeowner may qualify for a non-refundable tax credit under Section 25C of the IRC for expenditures made for the advanced main air. Your central air conditioning unit may qualify for an energy credit if it meets the energy efficiency requirementsYoull enter the cost of the CAC under How much did you pay for energy-saving improvementsas an Energy-Efficient Building Property. How to Claim the Energy Tax Credit.

If an advanced main air circulating fan that meets the definition of Qualified Energy Property in Section 25C of the IRC is installed in the homeowners principal residence and is placed in service between January 1 2021 and December 31 2021 then the homeowner may qualify for a non-refundable tax credit under Section 25C of the IRC for expenditures made for the advanced main air. If you qualify the credit will be worth 30 of the costs of. The IRS has directed taxpayers to use Form 5695 to calculate and file for their residential energy credits.

Yes the residential energy efficient property credit allows for a credit equal to the applicable percent of the cost of qualified property. Air-source heat pumps Heat pumps that are ENERGY STAR certified qualify for a 300 tax credit. People Also Asked Is there a tax credit for air conditioners in 2019.

Solar panels for generating electricity in a residential property. And 300 for any item of energy efficient building property. Where do I enter the tax credit for having a qualified air conditioning system installed in our home in 2016.

The maximum tax credit for a furnace circulating fan is 50. 150 for any qualified natural gas propane or oil furnace or hot water boiler. A maximum of 500 credit for all years combined 2006 to present.

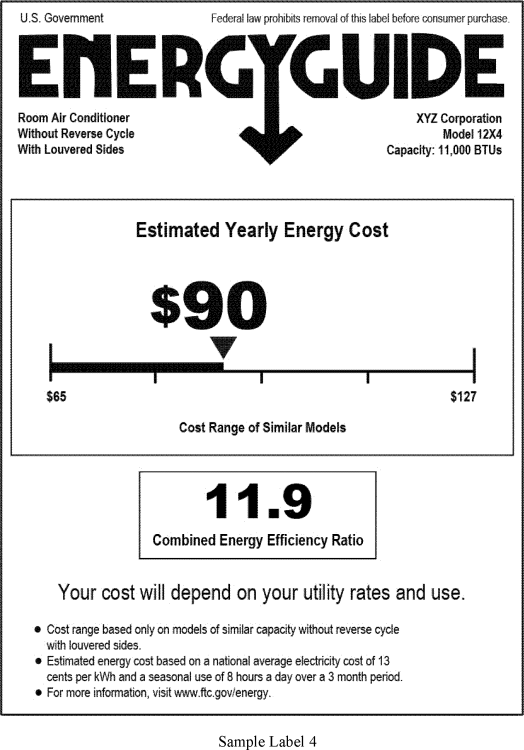

Air conditioners recognized as ENERGY STAR Most Efficient meet the requirements for this tax credit. For more information on federal energy tax credits visit Energystargov. Details of the Nonbusiness Energy Property Credit Extended through December 31 2019 You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

Both split and package system central air. ENERGY STAR Products That Qualify for Federal Tax Credits. Your energy-efficient central air-conditioning system may qualify for an energy credit.

Geothermal systems do qualify for tax credits. A credit limit for residential energy property costs for 2020 of 50 for any advanced main air circulating fan. Now as of January 15 2021 the Tax Credit has been extended again.

Window or portable units do not qualify. To apply for the Residential Energy Property Credit complete Form 5695 and attach it to your Form 1040. Gas propane or oil boilers Gas powered boilers.

Air Conditioning Maintenance Fun Facts Infographic Airconditioning Acmaintenance Infographi Air Conditioning Maintenance Air Conditioner Prices Hvac Humor

Ductlessaire 21 Seer 24 000 Btu Wi Fi Ductless Mini Split Air Conditioner And Heat Pump Variable Speed Inverter 220v 60hz Da2421 H2 The Home Depot

5 Things To Know Before Cleaning Your Home S Air Ducts Air Ducts Hvac Installation Hvac Contractor

300 Federal Tax Credit For Air Conditioners Kobie Complete

Http Kingtecsolar Com Products Solar Assisted Air Conditioning K25xd 4 K50xd 4 K25xd 4 K50xd 4 Sp Solar Powered Air Conditioner Solar Air Conditioner Solar

Extended 300 Federal Tax Credits For Air Conditioners And Heat Pumps Symbiont Air Conditioning

Buy Air Conditioner Daikin Wall Split Ac Ftxc50c Rxc50c Climamarket Online Store

How To Identify Freon Leaks In Your A C Hvac Air Conditioning Refrigeration And Air Conditioning Hvac

Rebates For New Air Conditioning Units 2021 10 Tax Deductibles

Ac Repair Service In Sunrise By Monar Ac Air Conditioning Repair Air Conditioning Installation Ac Repair

Infographic 7 Advantages Of Ductless Split Air Conditioners Infographics Creator Ductless Split Air Conditioner Ductless Ductless Heating

:max_bytes(150000):strip_icc()/81H2KJmj-4L._AC_SL1500_-cf16f89de97d4975880e8f4d494f4c98.jpg)

The 7 Best Energy Efficient Air Conditioners Of 2021

A Buyers Guide To Portable Air Conditioning In South Africa 2019 Gmc Airconditioning Cc

Air Conditioner Efficiency Egee 102 Energy Conservation And Environmental Protection

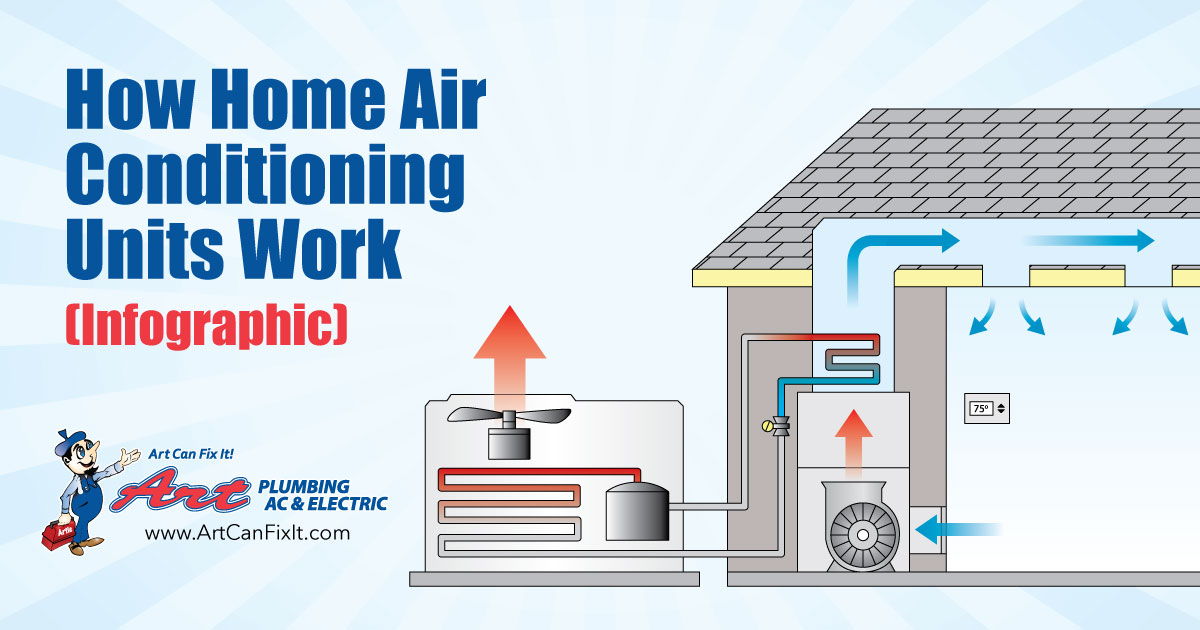

The Components Of Home Air Conditioning Units And How They Work

Single Phase Motor Wiring Diagram With Capacitor Start Compressor Ac Capacitor Capacitor

Pin By Bart Ettema On Solar Power For Home Life Solar Panels For Home Solar House Alternative Energy

Posting Komentar untuk "Do Air Conditioners Qualify For Residential Energy Credit"